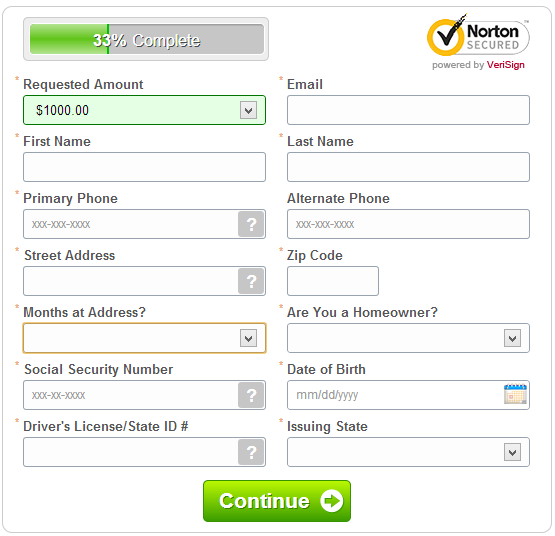

Though organizations tend not to lend money to those who cannot afford it, the application procedure is quite simple, comparing to borrowing a considerable sum of money from a bank. Less paperwork has to be carried out, and in some cases there is no such thing since a payback advance can be provided online. The whole process of getting a short-term unsecured loan is fast and only requires a borrower's postdated check to the lender which contains the full amount of the loan plus commission. A borrower has to repay the loan in person otherwise the check is to be redeemed. Insufficient funds on the borrower's bank account may result into a bounced check fee (depending on the contract and local legislation). In case of an online borrowing operation the sum shall be withdrawn from the account electronically. Nowadays lots of companies offer this type of service, terms and options varying from state to state. But in general all of them have the following advantages you should consider before applying for one:

1. Easy way to get out of trouble

Payday loan is considered to be one of the best methods to handle an unexpected financial situation.

2. Affordability and simplicity of the payday loan procedure

Payback loans can be available to those with low income. The procedure requires minimum documentation and banking operations.

3. The loan is obtained regardless your credit history

As a rule, payback lenders approve customers without going into a long process of checking your credit history, which makes the application easy and less time-consuming.

4. It is one of the quickest ways of getting cash money

That's why such type of crediting is gaining popularity. In fact, this is what customers pay commission for. The quickness of obtaining cash money can sometimes be of vital importance. Don't have enough finance to pay everyday expenses? Badly need money to repair your car or a member of your family has a medical emergency? Have faced with some unexpected need? Having tough time dealing with collection agencies on your back? Then applying for payday loan is one of the best variants possible.

5. Sometimes getting payback loan can save you from serious problems

Let's imagine that you have taken a mortgage. It is for regular credit payment, but you do not have enough and you can lose your house. Comparing the cost of a short-term loan to the cost of missing a payment or, God forbid, losing your belongings, payday loan might be cheaper.

6. Taking a loan from a credit organization is simply business

Some people prefer dealing with credit organizations to asking for money from their friends or relatives, though the latter does not include fees. When you do not want emotions to get involved just go to the bank.

7. Various ways of submitting your application

Don't feel like leaving the house, visiting banks and talking to people? There are a lot of ways you can get the loan. Apply online using information on plenty of web-pages where you can find the most satisfying terms of borrowing.

8. Reliable back-up plan

You may use payday loan in order not to purchase new items, but as an instant cash cushion in case of an emergency situation.

9. Such loans are paid back fast

The debt to be paid back within a couple of weeks. It being covered, you are free from obligations and can live your life stress free.

10. Reduced amount of stress

To think of it, you are taking what already belongs to your - your salary - but a little bit earlier. Since you expect the salary to come within a few days, you won't have troubles returning the money.